Trolley Payout Solutions: Enterprise Framework for Global Payment Distribution

Introduction

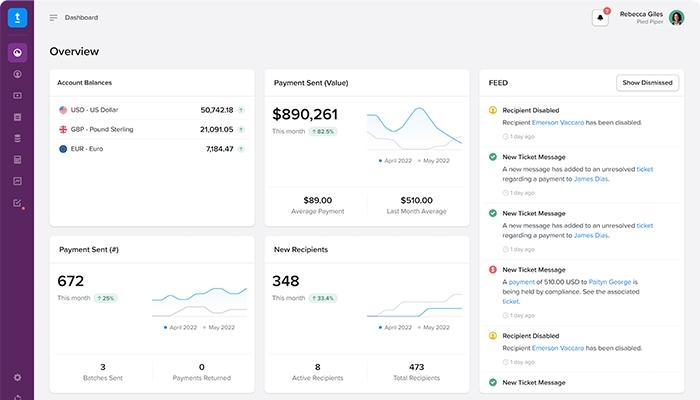

Global digital platforms require more than simple bank transfers. When a business distributes funds to creators, partners, sellers, or contractors across multiple countries, the payout process becomes a core operational function.

A trolley payout system provides a structured framework for managing international disbursements with compliance, automation, and scalability built into the workflow. This article explores the strategic, technical, and operational dimensions of trolley payout infrastructure.

Overview of Trolley Payout Infrastructure

4

The term trolley payout is associated with solutions developed by Trolley. The platform supports businesses that need to send mass payments worldwide while integrating compliance and tax documentation into the payout lifecycle.

Rather than managing individual bank integrations country by country, platforms can centralize operations within a single payout environment.

Operational Lifecycle of a Trolley Payout System

1. Digital Recipient Onboarding

Recipients securely submit:

- Bank account details

- Currency preferences

- Tax forms (W-8, W-9)

- Identity verification information

Digital onboarding reduces errors and speeds up verification processes.

2. Compliance & Regulatory Controls

4

Before funds are released, automated screening may include:

- Sanctions list checks

- Anti-money laundering monitoring

- Fraud detection algorithms

- Audit logging

Compliance automation reduces exposure to regulatory penalties.

3. Payment Execution & Banking Rails

Supported payout rails commonly include:

- ACH (United States)

- SEPA (European Union)

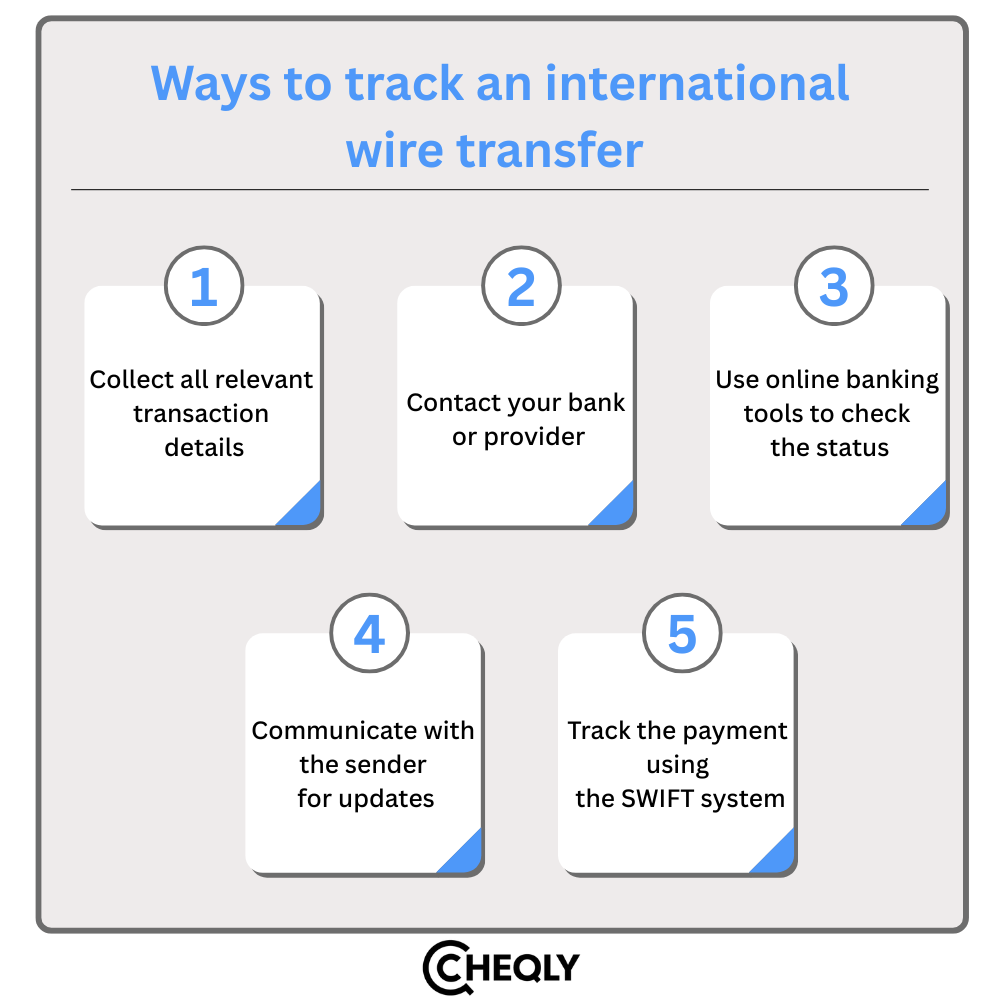

- SWIFT (international transfers)

- Local bank transfer networks

- Multi-currency settlements

Businesses can schedule:

- Bulk disbursements

- Recurring payouts

- API-triggered transfers

- Manual dashboard payments

Automation ensures predictable payment cycles.

4. Reporting & Financial Oversight

Transparency tools often provide:

- Real-time payout tracking

- Error and rejection notifications

- Downloadable transaction reports

- Year-end tax reporting summaries

Clear reporting simplifies accounting workflows.

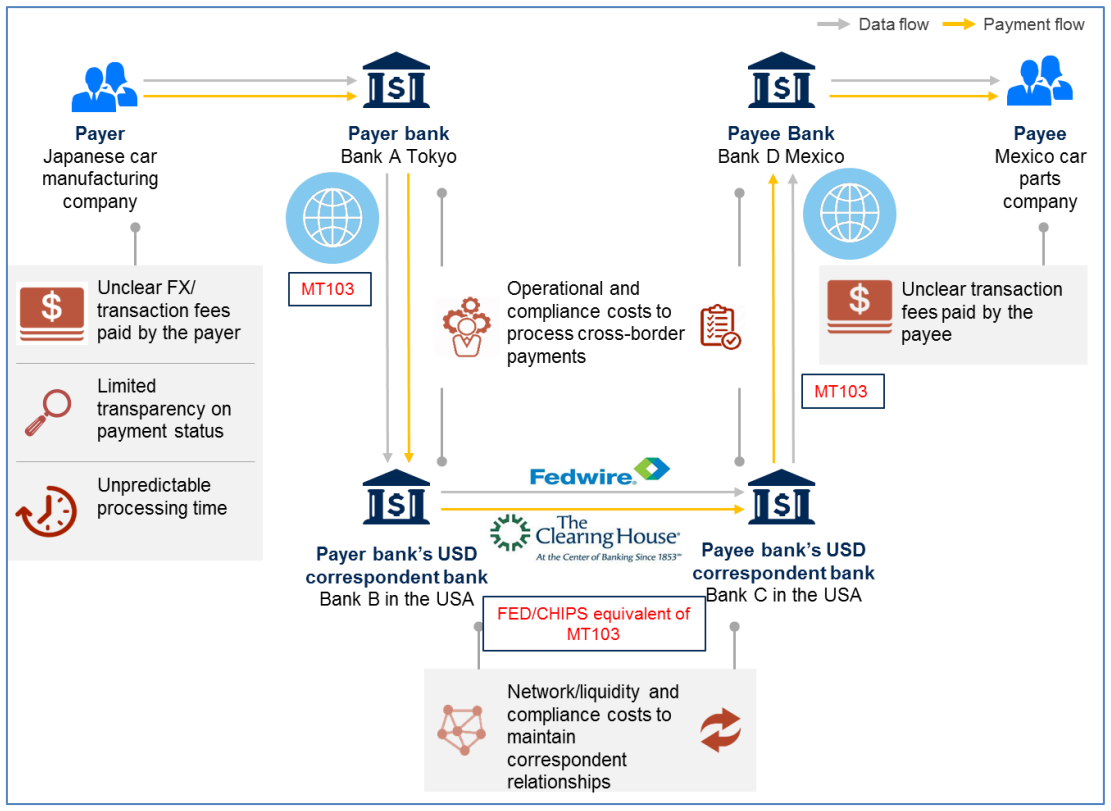

Multi-Currency & Cross-Border Payment Optimization

4

Global payouts involve:

- Currency exchange considerations

- Regional banking regulations

- Settlement time variations

- Foreign exchange cost oversight

A trolley payout framework typically centralizes currency management and provides visibility into cross-border payment flows.

Tax Documentation & Automation

Tax compliance requirements vary by jurisdiction. Automated payout systems often support:

- Digital W-9 collection

- W-8 series forms for non-U.S. recipients

- Tax identification validation

- Exportable reporting for annual filings

Integrating tax workflows directly into payout systems reduces administrative friction.

This article is informational only and does not provide legal or tax advice.

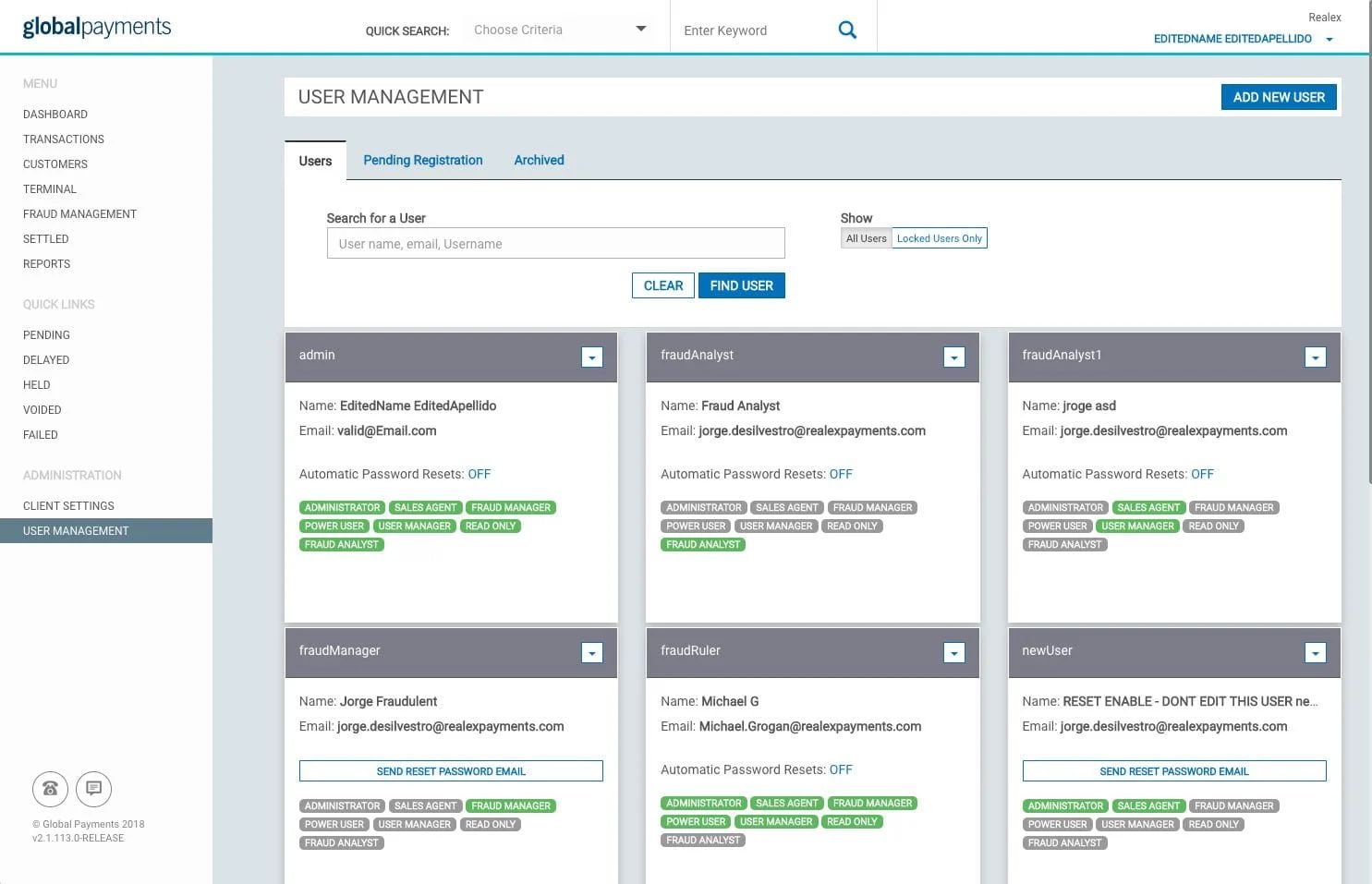

Security Infrastructure

Security architecture within trolley payout systems typically includes:

- Encrypted data storage

- Secure API authentication

- Role-based access control

- Detailed audit trails

- Real-time monitoring alerts

Financial infrastructure requires strong data protection and oversight.

Developer & API Capabilities

Engineering teams evaluating trolley payout systems often look for:

- REST API integration

- Webhook event notifications

- Sandbox testing environments

- Bulk payout upload tools

- Scheduled automation logic

Flexible APIs allow seamless integration into marketplace and SaaS ecosystems.

Strategic Benefits of Trolley Payout Infrastructure

Organizations adopt trolley payout systems to achieve:

- Global scalability

- Reduced compliance risk

- Centralized disbursement management

- Automated documentation workflows

- Improved operational efficiency

For high-growth platforms, payout automation supports long-term stability.

Search Intent Behind “Trolley Payout”

Users searching for this term often include:

- Business operators researching global payout providers

- Developers reviewing API capabilities

- Recipients verifying payment legitimacy

- Compliance professionals evaluating documentation systems

Providing neutral, structured, and educational content supports sustainable SEO performance.

Final Thoughts

A trolley payout system acts as a centralized global disbursement engine for digital platforms requiring compliance integration, multi-currency support, and scalable automation.

As international digital commerce continues to grow, structured payout infrastructure becomes foundational to operational success.