Trolley Payout Platform: Advanced Guide to Global Disbursement, Compliance, and Payment Automation

Introduction

Global platforms distributing funds to thousands of users face operational challenges that traditional banking tools were never designed to solve. Managing international transfers, tax documentation, compliance checks, and reporting workflows requires a structured system.

A trolley payout solution provides centralized automation for global disbursements, combining payment execution with compliance and tax management. This article explores the infrastructure behind trolley payout systems and how they support scalable digital ecosystems.

What Is Trolley Payout?

4

The phrase trolley payout is closely associated with services developed by Trolley. The platform enables businesses to send mass payments across multiple countries while integrating compliance and tax documentation workflows.

Rather than relying on fragmented banking connections, companies use trolley payout systems to centralize disbursement processes within a single infrastructure layer.

Structural Components of a Trolley Payout System

A scalable trolley payout architecture generally includes:

1. Recipient Onboarding Module

Recipients provide:

- Bank account information

- Currency preferences

- Tax documentation (W-8, W-9)

- Identity verification data

Digital onboarding reduces administrative workload and improves data accuracy.

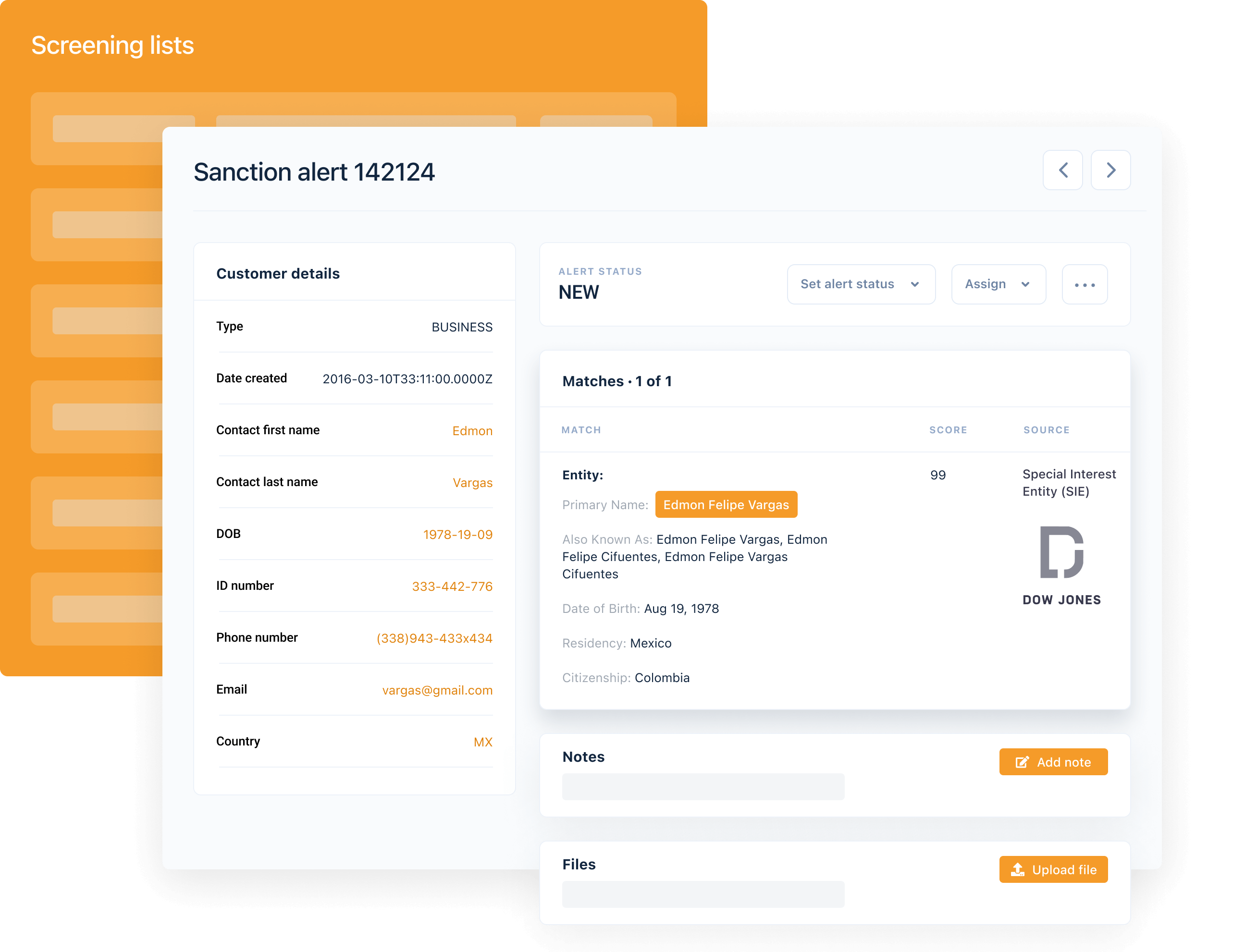

2. Compliance & Risk Management Layer

4

Before payments are released, automated systems may perform:

- Sanctions list screening

- Anti-money laundering checks

- Fraud detection analysis

- Activity logging for audits

Compliance automation minimizes exposure to regulatory risks.

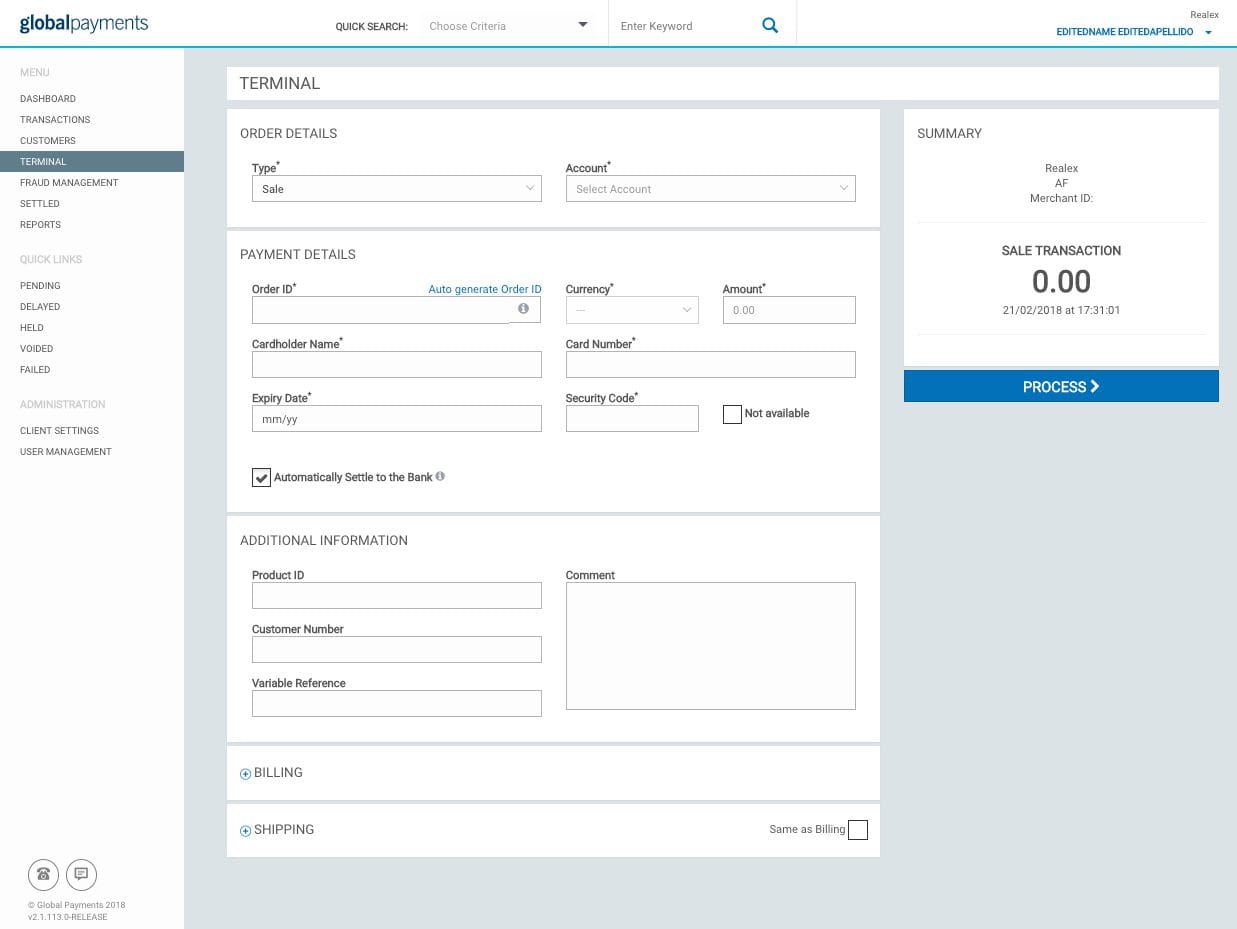

3. Payment Execution Engine

Common payout rails supported include:

- ACH (United States)

- SEPA (European Union)

- SWIFT (international transfers)

- Local banking networks

- Multi-currency settlements

Businesses can initiate:

- Bulk payouts

- Scheduled recurring payments

- API-triggered transfers

- Manual dashboard payments

4. Reporting & Reconciliation Tools

Operational oversight requires transparency. Typical features include:

- Real-time payment status

- Failed transfer notifications

- Downloadable transaction reports

- Year-end tax documentation summaries

These tools support accounting and compliance workflows.

Cross-Border Payment Infrastructure

4

International disbursements require:

- Currency conversion management

- Local regulatory compliance

- Settlement time tracking

- FX cost oversight

A trolley payout framework typically allows platforms to centralize foreign exchange management and monitor transfer performance globally.

Tax Documentation Automation

Tax compliance is often integrated directly into payout workflows.

Automation may support:

- Digital W-9 collection

- W-8 series forms for international recipients

- Tax identification validation

- Year-end reporting exports

Embedding documentation into payout systems reduces administrative friction.

This article is informational only and does not constitute legal or tax advice.

Security Architecture

Modern payout infrastructure typically includes:

- Encrypted data storage

- Secure API authentication protocols

- Role-based access permissions

- Detailed audit trails

- Real-time transaction monitoring

Strong security architecture is fundamental for protecting financial data.

Developer & Integration Considerations

Engineering teams evaluating trolley payout systems often look for:

- REST API endpoints

- Webhook-based event notifications

- Sandbox testing environments

- Bulk CSV payout options

- Automated scheduling logic

Integration flexibility supports long-term scalability.

Strategic Advantages of Trolley Payout Infrastructure

Businesses adopt trolley payout systems to achieve:

- Operational efficiency

- Reduced compliance risk

- Automated tax documentation

- Centralized reporting

- Scalable global expansion

For growing platforms, payout infrastructure becomes strategic—not merely operational.

Search Intent Behind “Trolley Payout”

Search queries related to trolley payout often come from:

- Businesses evaluating global payout providers

- Developers researching API capabilities

- Recipients verifying payment legitimacy

- Compliance professionals reviewing documentation workflows

Providing structured, neutral, and informative content supports long-term search visibility.

Final Thoughts

A trolley payout solution serves as a global disbursement engine for digital platforms requiring automation, compliance integration, and multi-currency support.

As digital ecosystems expand internationally, structured payout infrastructure enables operational stability and regulatory alignment.