Trolley Payout Infrastructure: A Strategic Guide for Global Payment Automation

Introduction

Scaling a digital platform is not only about user growth—it’s about financial infrastructure. When a company begins distributing funds to thousands of users across multiple countries, payout operations quickly become complex.

A trolley payout system provides structured global disbursement infrastructure designed for automation, compliance, and operational control. In this guide, we explore how trolley payout architecture works, its strategic advantages, and implementation considerations.

What Is Trolley Payout?

4

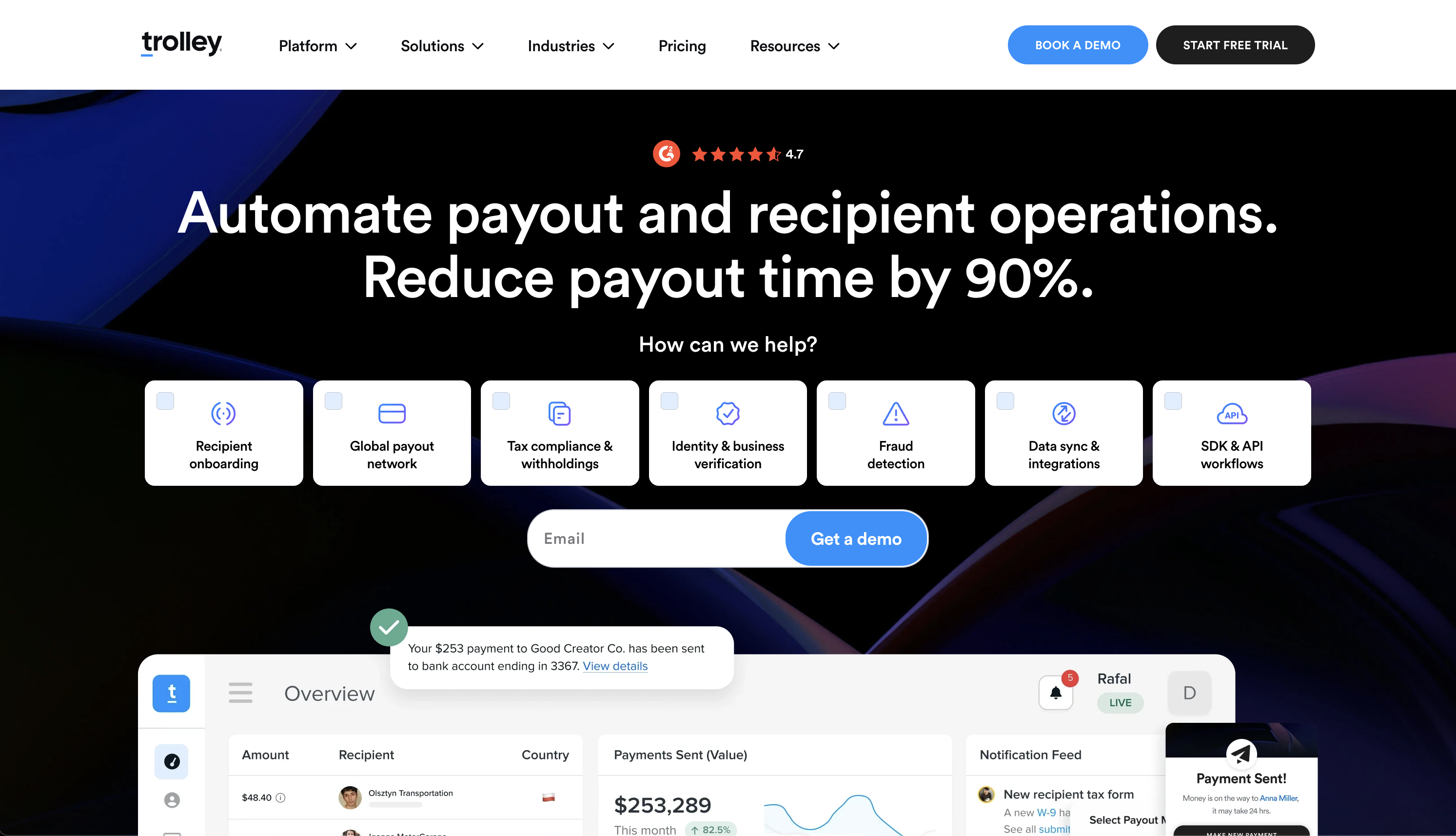

The phrase trolley payout is commonly associated with the payment and compliance solutions offered by Trolley. The platform is designed for businesses that need to send large volumes of payments across borders while managing tax and regulatory workflows.

Unlike traditional banking tools, trolley payout infrastructure centralizes:

- Multi-currency transfers

- Tax form automation

- Recipient onboarding

- Compliance screening

- Transaction reporting

This makes it suitable for high-scale digital ecosystems.

Architectural Overview of a Trolley Payout System

A robust trolley payout framework typically consists of four key layers:

1. Onboarding Layer

Recipients securely submit:

- Banking details

- Identity documentation

- Tax forms (W-8, W-9)

- Currency preferences

Automation reduces friction while ensuring data accuracy.

2. Compliance & Risk Layer

4

This layer may include:

- Sanctions screening

- Anti-money laundering checks

- Fraud detection algorithms

- Audit trail logging

Compliance automation protects businesses from regulatory exposure.

3. Payment Processing Layer

Payment rails commonly supported:

- ACH (U.S.)

- SEPA (Europe)

- SWIFT (International)

- Local bank networks

- Multi-currency settlements

Businesses can initiate:

- Batch payouts

- Scheduled disbursements

- API-triggered transfers

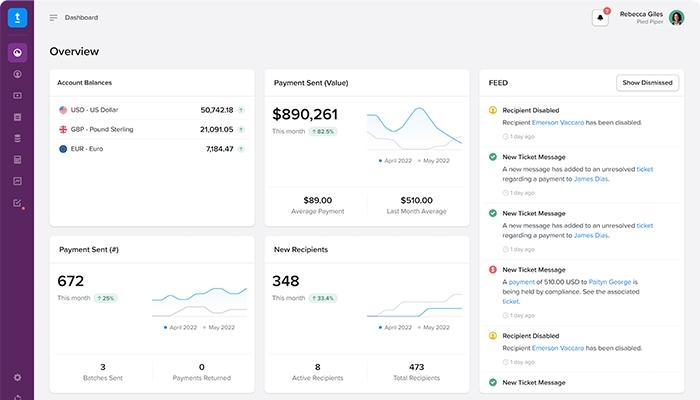

4. Reporting & Reconciliation Layer

Operational visibility is essential. Tools typically provide:

- Real-time status tracking

- Payment failure alerts

- Exportable financial reports

- Tax reporting summaries

These features simplify accounting workflows.

Use Cases for Trolley Payout Infrastructure

4

Industries that frequently rely on trolley payout systems include:

- Creator monetization platforms

- Affiliate marketing networks

- Online marketplaces

- SaaS subscription ecosystems

- Ad-tech platforms

- Gig economy services

Any organization distributing funds at scale can benefit from centralized automation.

Cross-Border Disbursement Strategy

International payouts involve:

- Foreign exchange considerations

- Local banking regulations

- Regional settlement timelines

- Currency conversion management

A trolley payout framework typically allows:

- Payments in recipient-local currency

- Centralized FX handling

- Transparent transaction monitoring

- Reduced operational fragmentation

This supports international growth strategies.

Tax Documentation Automation

4

Tax compliance is often integrated into payout systems.

Automation may support:

- Digital W-9 collection

- W-8 series forms for international payees

- TIN validation

- Year-end reporting preparation

By embedding tax workflows into the payout cycle, administrative overhead is reduced.

This content is informational only and not legal advice.

Security & Data Protection

Security within trolley payout infrastructure typically includes:

- Encrypted data transmission

- Secure API authentication

- Role-based access control

- Detailed audit logging

- Transaction monitoring systems

Maintaining high security standards protects both platform operators and recipients.

Developer Integration & API Flexibility

Engineering teams often evaluate:

- RESTful APIs

- Webhook notifications

- Sandbox environments

- Bulk CSV upload tools

- Scheduling logic automation

Integration flexibility determines long-term scalability.

Evaluating Trolley Payout Solutions

When assessing payout infrastructure, businesses should review:

- Geographic coverage

- Currency support

- Compliance certifications

- Data security standards

- Integration complexity

- Scalability potential

- Pricing transparency

A strategic evaluation prevents costly system migrations later.

Search Intent Behind “Trolley Payout”

Searchers typically include:

- Businesses researching payout automation

- Developers reviewing integration options

- Recipients verifying payment sources

- Compliance professionals analyzing workflows

Structured, neutral, and fact-based content improves alignment with search quality guidelines.

Final Thoughts

A trolley payout system serves as a scalable global disbursement engine for digital platforms. By integrating multi-currency payments, compliance screening, tax documentation automation, and API-driven execution, it supports sustainable international operations.

As global digital ecosystems continue to expand, payout infrastructure becomes foundational—not optional.