Trolley Payout: Enterprise-Grade Global Disbursement Infrastructure for Digital Platforms

Introduction

As digital businesses expand internationally, payout complexity increases exponentially. Managing cross-border transfers, tax documentation, compliance screening, and reconciliation across thousands of recipients requires structured infrastructure.

A trolley payout system offers centralized automation for global disbursements. Designed for scalability, compliance, and operational control, it helps platforms distribute funds efficiently while minimizing regulatory exposure.

This guide explores the architectural components, operational benefits, and strategic considerations behind trolley payout systems.

What Is Trolley Payout?

4

The term trolley payout is widely associated with solutions developed by Trolley. The platform enables businesses to send payments globally while integrating tax compliance, identity verification, and reporting tools.

Unlike consumer payment apps, trolley payout systems are built for businesses that need to manage large-scale disbursement operations.

The Four Layers of a Trolley Payout Architecture

1. Recipient Onboarding Layer

Recipients submit:

- Bank account information

- Preferred currency

- Tax documentation (W-8, W-9, etc.)

- Identity verification details

Automated workflows reduce onboarding friction while ensuring compliance accuracy.

2. Compliance & Risk Layer

4

Before funds are released, the system may perform:

- Sanctions screening

- Anti-money laundering checks

- Fraud risk assessments

- Audit trail logging

This layer protects businesses from financial and reputational risks.

3. Payment Execution Layer

The payment engine typically supports:

- ACH (U.S. transfers)

- SEPA (European transfers)

- SWIFT (international transfers)

- Local bank rails

- Multi-currency disbursements

Businesses can trigger:

- One-time payouts

- Recurring disbursements

- Bulk batch transfers

- API-automated payments

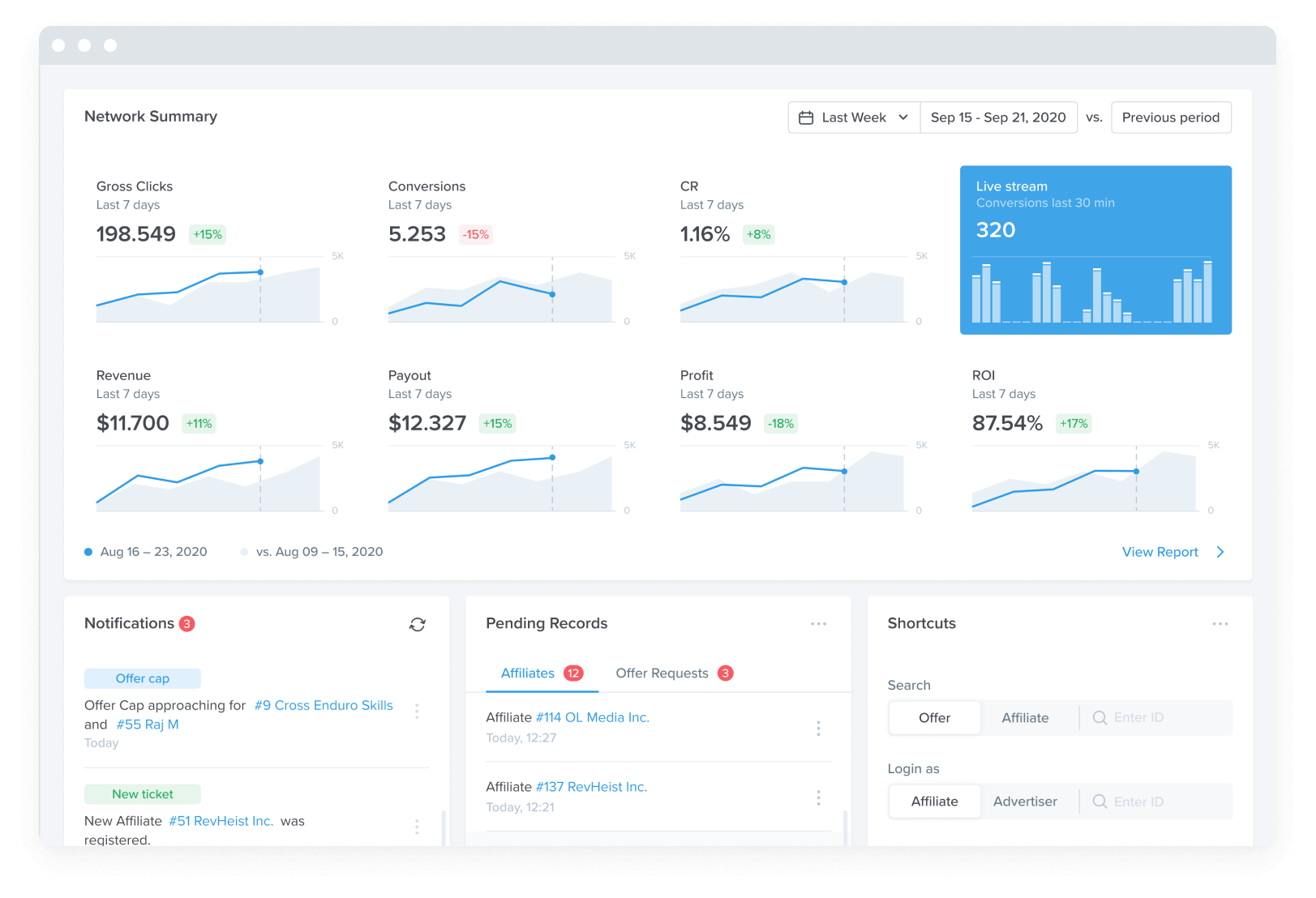

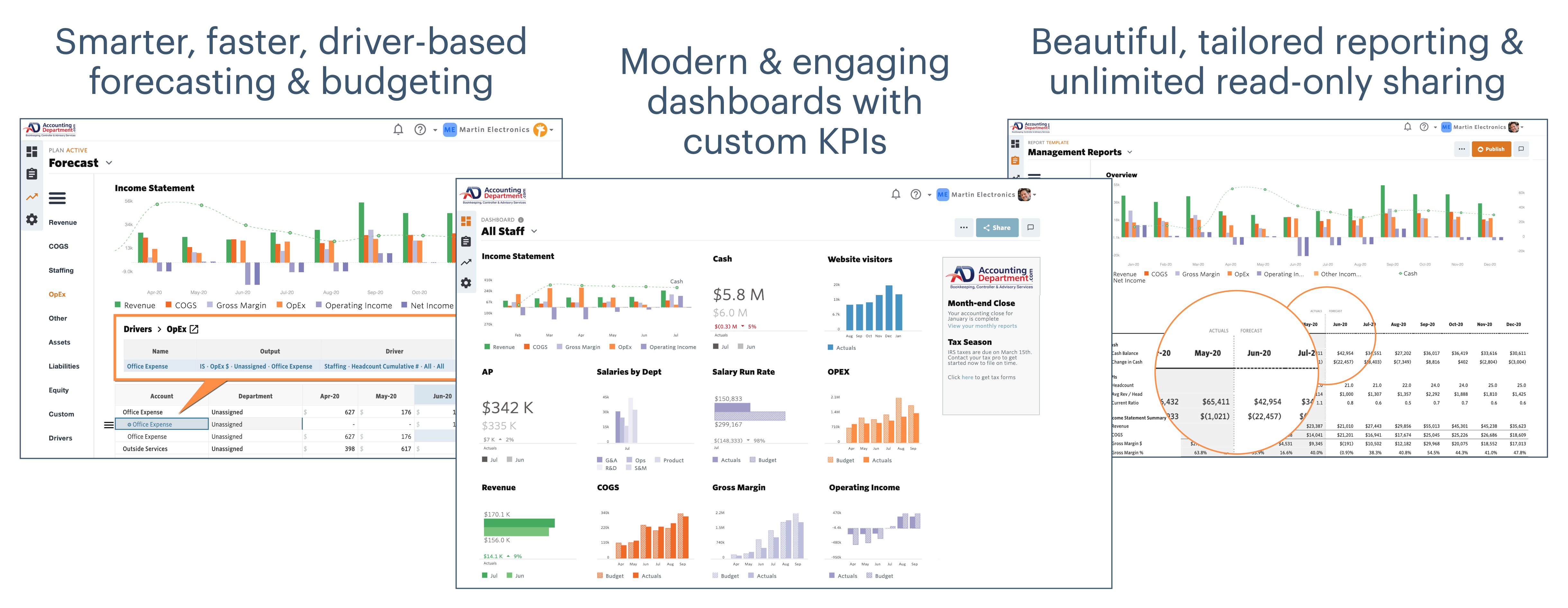

4. Reporting & Reconciliation Layer

Platforms require clear oversight of payout flows. Reporting tools often include:

- Real-time payment tracking

- Failure notifications

- Exportable transaction logs

- Year-end reporting summaries

These capabilities simplify accounting and compliance preparation.

Why Scalable Platforms Adopt Trolley Payout Systems

4

Organizations benefiting from trolley payout infrastructure commonly include:

- Online marketplaces

- Creator monetization platforms

- Affiliate marketing networks

- Gig economy services

- SaaS ecosystems

- Fintech startups

When platforms grow internationally, payout infrastructure becomes a strategic advantage.

Cross-Border Payment Optimization

Global disbursements require managing:

- Currency exchange volatility

- Local settlement times

- Regulatory reporting

- Bank network compatibility

A trolley payout framework typically allows businesses to:

- Send funds in recipient-preferred currency

- Centralize foreign exchange management

- Track cross-border settlement timelines

- Reduce reconciliation complexity

This helps maintain operational consistency across markets.

Tax Automation and Documentation

4

For U.S.-based or globally operating companies, tax compliance is mandatory.

Automated payout systems can assist with:

- Digital W-9 collection

- W-8 series forms for international recipients

- Tax form validation

- Year-end reporting preparation

By integrating documentation into the payout workflow, administrative burden decreases significantly.

This content is informational and does not constitute legal or tax advice.

Security Framework

A secure trolley payout environment typically includes:

- Encrypted data storage

- Secure API authentication

- Role-based access control

- Activity logging

- Transaction monitoring alerts

Security architecture is fundamental to maintaining trust and regulatory compliance.

Developer Integration Considerations

Engineering teams often evaluate:

- REST API endpoints

- Webhook event notifications

- Sandbox testing environments

- Bulk payout upload tools

- Scheduling automation

Flexible API architecture allows seamless integration into existing platform ecosystems.

Strategic Evaluation Checklist

Before selecting a trolley payout system, businesses should assess:

- Geographic payout coverage

- Supported currencies

- Compliance certifications

- Data security protocols

- Integration complexity

- Scalability limits

- Transparent pricing structure

Long-term growth strategy should guide infrastructure decisions.

Understanding Search Intent Behind “Trolley Payout”

Search queries typically come from:

- Businesses researching payout infrastructure

- Developers seeking integration details

- Recipients verifying payment sources

- Compliance teams reviewing automation tools

Creating structured, neutral, and educational content aligns with search quality guidelines and improves long-term SEO sustainability.

Final Thoughts

A trolley payout infrastructure serves as a centralized disbursement engine for modern digital platforms. By integrating compliance automation, tax documentation workflows, multi-currency payment rails, and API-driven execution, it supports scalable international operations.

As digital economies continue expanding, payout automation becomes not just operational support—but strategic infrastructure.