Trolley Payout: Complete Guide to Global Payment Automation, Compliance, and Scalable Disbursements

Introduction

Managing mass payments across borders is one of the biggest operational challenges for modern platforms. Whether you run a marketplace, fintech product, creator platform, affiliate network, or gig ecosystem, handling secure, compliant, and scalable payouts is critical.

A trolley payout solution is designed specifically for businesses that need to distribute funds globally while maintaining tax compliance, regulatory accuracy, and operational efficiency. This guide explains how it works, who it’s for, and why it has become popular in digital-first industries.

What Is Trolley Payout?

4

Trolley payout refers to the global payment infrastructure provided by Trolley, a fintech company that helps platforms send mass payments worldwide.

It combines:

- Global bank transfers (ACH, SEPA, SWIFT)

- Local currency payouts

- Digital wallet disbursements

- Automated tax form collection (W-8, W-9, etc.)

- Identity verification

- Compliance screening

The system is built for platforms that need to send money to thousands—or even millions—of recipients.

Why Businesses Use Trolley Payout

Modern digital platforms face three core payout challenges:

- International banking complexity

- Tax reporting requirements

- Fraud and compliance risks

A properly configured trolley payout workflow helps solve these issues through automation and centralized controls.

Key Advantages

✔ Multi-currency payments

✔ Built-in compliance tools

✔ Automated tax documentation

✔ API-based integration

✔ Bulk payment capabilities

✔ Real-time payout tracking

For SEO purposes, it’s important to understand that companies searching for “trolley payout” are usually looking for operational clarity, integration details, or compliance guidance—not just marketing descriptions.

How Trolley Payout Works

4

Here’s a simplified breakdown of the payout process:

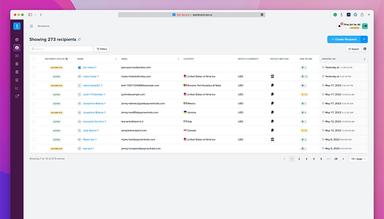

1. Recipient Onboarding

Recipients securely submit:

- Bank details

- Tax forms (W-8BEN, W-9, etc.)

- Identity verification data

2. Compliance Screening

The system runs:

- Sanctions screening

- Fraud detection

- KYC/AML checks

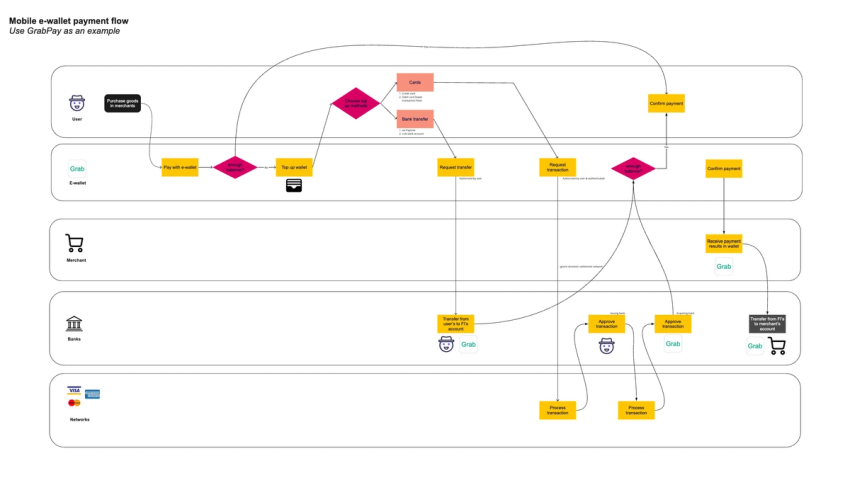

3. Payment Execution

Businesses initiate:

- Batch payouts

- Scheduled payments

- API-triggered disbursements

Funds are delivered via local rails or international networks.

4. Reporting & Reconciliation

Companies receive:

- Payment status updates

- Failed payout alerts

- Tax reporting exports

Who Uses Trolley Payout?

Trolley payout systems are commonly used by:

- Creator platforms

- Affiliate marketing networks

- Online marketplaces

- Ad-tech companies

- SaaS platforms

- Gig economy services

- Web3 and fintech ecosystems

If you’re building large-scale content or fintech hubs (which you often analyze), payout infrastructure becomes one of the most critical backend components.

Compliance & Tax Automation

One of the strongest features of trolley payout infrastructure is tax automation.

Businesses operating in the U.S. must collect proper tax documentation from recipients. Instead of managing this manually, the system helps automate:

- W-9 collection (U.S. residents)

- W-8 forms (non-U.S. residents)

- Year-end reporting (e.g., 1099 preparation)

This significantly reduces compliance risk.

Important: Always consult a qualified tax professional for regulatory advice. This article is informational only.

Integration Options

For technical teams, trolley payout solutions offer:

- REST APIs

- Webhooks

- Dashboard controls

- CSV bulk uploads

This flexibility makes it scalable for both startups and enterprise-level operations.

If you're building SEO-driven informational hubs about payout platforms, integration transparency improves content trust and ranking performance.

Security Standards

4

Payment security is a core concern in global disbursements.

Trolley payout infrastructure typically includes:

- Encrypted data transmission

- Role-based access controls

- Audit logs

- AML screening

- Regulatory monitoring

These elements reduce operational and reputational risk.