Trolley Payout Guide: Architecture, Compliance, and Global Disbursement Strategy

Introduction

As digital ecosystems scale, distributing funds efficiently becomes a mission-critical function. Marketplaces, SaaS platforms, affiliate networks, and creator economies all depend on reliable global payout systems.

A trolley payout framework offers structured infrastructure for sending mass payments while managing compliance, tax documentation, and security controls. This guide explores the architecture behind modern payout systems and how businesses can evaluate them strategically.

Understanding the Trolley Payout Model

4

The term trolley payout is commonly associated with the global payment infrastructure developed by Trolley. The system allows businesses to distribute payments to recipients worldwide while automating documentation and compliance processes.

Rather than building internal banking connections in each country, platforms can centralize payouts within one operational layer.

Core Infrastructure Components

A trolley payout architecture typically includes the following layers:

1. Recipient Data Layer

- Secure onboarding portals

- Bank account verification

- Tax form submission

- Identity validation

2. Compliance Engine

- Sanctions list screening

- AML monitoring

- Fraud detection checks

- Audit trail generation

3. Payment Rails Integration

- ACH (U.S.)

- SEPA (EU)

- SWIFT (international)

- Local bank transfers

- Multi-currency support

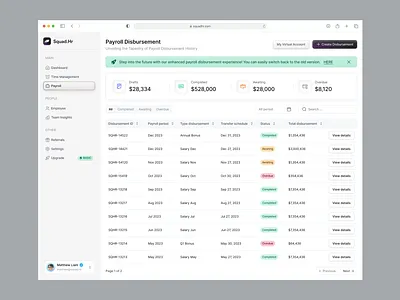

4. Reporting & Analytics

- Transaction tracking

- Failed payout alerts

- Exportable financial reports

- Year-end tax summaries

Each layer contributes to operational stability.

Why Global Platforms Prioritize Automated Payouts

4

Businesses using trolley payout infrastructure often face:

- Thousands of recipients

- Cross-border currency exchanges

- Regulatory obligations

- Tax reporting deadlines

- Data privacy requirements

Manual workflows increase the risk of:

- Payment delays

- Incorrect transfers

- Compliance violations

- Administrative bottlenecks

Automation reduces these risks significantly.

Multi-Currency & Cross-Border Mechanics

Global payouts introduce complexity such as:

- Foreign exchange rates

- Local banking regulations

- Settlement timelines

- Regional compliance differences

A trolley payout framework generally allows:

- Payments in recipient-preferred currency

- Centralized currency management

- Status tracking across regions

- Automated reconciliation

For digital platforms expanding internationally, this reduces operational friction.

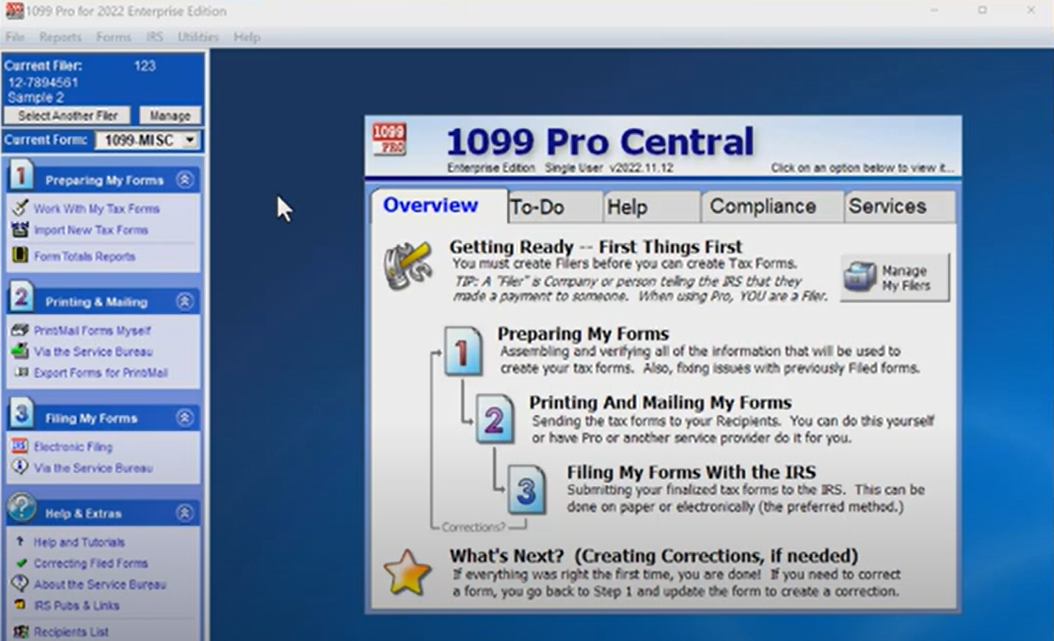

Tax and Regulatory Automation

4

Businesses distributing payments in regulated markets must collect proper documentation.

Automated payout systems typically assist with:

- W-9 collection (U.S. recipients)

- W-8 series forms (international recipients)

- TIN validation

- Year-end reporting preparation

This helps reduce compliance exposure.

This article is informational only and not legal or tax advice.

Security and Risk Controls

Security measures within trolley payout infrastructures often include:

- Encrypted data storage

- API authentication tokens

Security and Risk Controls

Security measures within trolley payout infrastructures often include:

- Encrypted data storage

- API authentication tokens

- Role-based user permissions

- Activity logging

- Transaction monitoring alerts

Robust security architecture protects both platforms and recipients.

Developer & API Considerations

For engineering teams, integration flexibility matters.

Common features include:

- RESTful API endpoints

- Webhooks for payout status updates

- Sandbox testing environments

- Bulk upload options (CSV)

- Automated scheduling logic

Proper integration ensures scalability as payout volumes grow.

Evaluating a Payout Provider Strategically

Before implementing a trolley payout solution, businesses should review:

- Geographic coverage

- Supported payout methods

- Compliance certifications

- Data security standards

- Pricing transparency

- Integration complexity

Long-term scalability is often more important than short-term implementation speed.

Search Intent Behind “Trolley Payout”

Users searching this term usually fall into one of three groups:

- Business operators researching payout platforms

- Developers reviewing API documentation

- Recipients verifying incoming funds

Providing structured, neutral, and educational content improves alignment with search quality guidelines.

Frequently Asked Questions

Is Trolley payout a bank?

No. It operates as a payment infrastructure provider rather than a consumer bank.

Can individuals independently register?

Typically, businesses integrate the system and invite recipients.

Does it support large-scale payouts?

Yes, it is designed for mass disbursements across multiple regions.

Final Thoughts

A trolley payout system functions as a centralized infrastructure layer for global payment distribution. By combining compliance automation, tax documentation, and multi-currency payment rails, it helps modern platforms operate efficiently at scale.

As digital economies grow, payout architecture becomes a competitive advantage—not just an operational necessity.