Trolley Payout Explained: Global Payment Infrastructure, Compliance Automation, and Scalable Disbursements

Introduction

As digital platforms expand globally, managing payments at scale becomes increasingly complex. Businesses must handle multi-currency transfers, tax documentation, compliance screening, and fraud monitoring—often across dozens of countries.

A trolley payout infrastructure helps streamline these processes by centralizing global disbursements within one automated system. In this guide, we break down how it works, who it serves, and what to evaluate before implementation.

What Is Trolley Payout?

4

The term trolley payout refers to the mass payment and compliance solutions provided by Trolley. The platform is designed to help businesses send payments to large numbers of recipients worldwide.

It typically combines:

- Global bank transfers (ACH, SEPA, SWIFT)

- Local currency disbursements

- Digital wallet options (depending on region)

- Automated tax form collection

- Sanctions and AML screening

- Centralized reporting dashboards

Rather than manually managing banking relationships in each country, businesses can use a unified payout infrastructure.

Why Modern Platforms Need Automated Payout Systems

Manual payment workflows create several operational risks:

- Delays in processing

- Incorrect bank details

- Tax compliance errors

- Regulatory exposure

- Reconciliation issues

A structured trolley payout workflow reduces human error and improves scalability.

Key Operational Benefits

✔ Automated onboarding

✔ Bulk and scheduled payments

✔ Integrated compliance checks

✔ Transparent reporting

✔ API-based automation

✔ Reduced administrative overhead

For companies operating in creator economies, affiliate networks, and gig marketplaces, automation directly impacts operational efficiency.

How Trolley Payout Works Step-by-Step

4

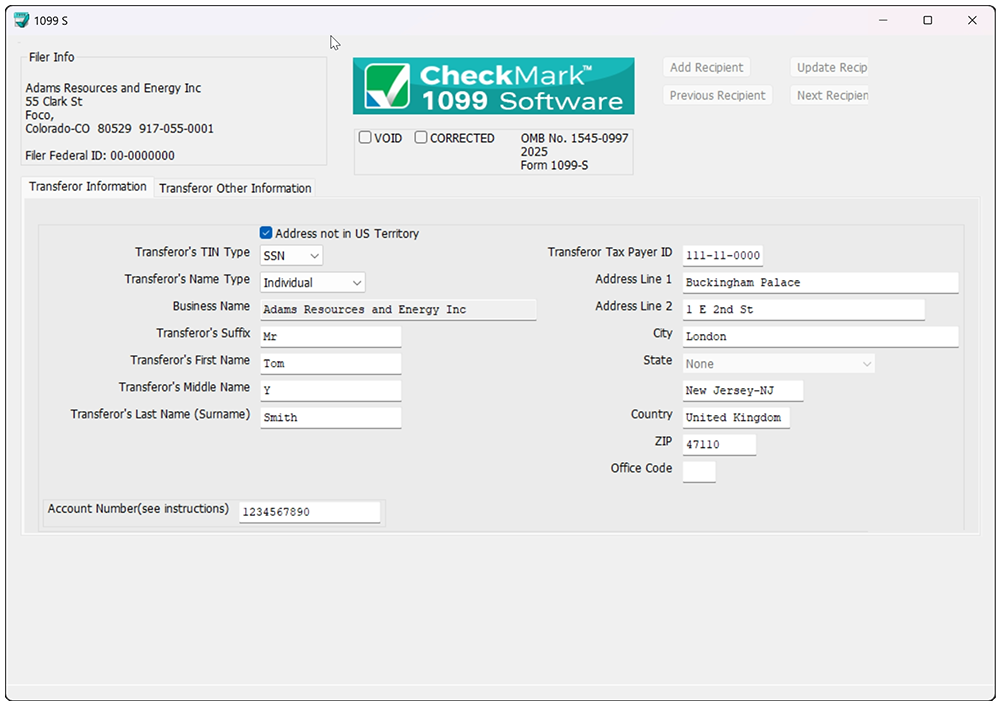

1. Recipient Registration

Recipients submit required details securely:

- Bank account information

- Tax documentation

- Identity verification data

2. Compliance & Verification

Automated systems may run:

- Sanctions screening

- AML checks

- Fraud detection

- Identity validation

3. Payment Initiation

Businesses trigger:

- One-time payments

- Recurring payouts

- Batch transfers

- API-driven automated disbursements

4. Monitoring & Reporting

Dashboards provide:

- Real-time status updates

- Error notifications

- Exportable transaction records

- Tax documentation summaries

Global Coverage & Multi-Currency Support

Cross-border payouts require:

- Local banking relationships

- Currency conversion handling

- Regional compliance standards

- Settlement tracking

A trolley payout infrastructure typically enables businesses to:

- Send funds in local currencies

- Avoid excessive FX friction

- Centralize international payouts

- Monitor transfer performance

This flexibility supports global expansion strategies.

Compliance and Tax Automation

4

Regulatory requirements vary by country and payment type. Businesses distributing funds in the U.S., for example, must collect proper tax documentation from recipients.

Automated payout systems often assist with:

- W-9 collection (U.S. persons)

- W-8 forms (international recipients)

- Tax form validation

- Year-end reporting exports

This reduces compliance risk and administrative burden.

Note: Always consult qualified legal or tax professionals for regulatory guidance.

Security Architecture

Security is foundational in global payment infrastructure. Trolley payout systems generally include:

- Encrypted data storage

- Secure API authentication

- Role-based access controls

- Detailed audit trails

- Transaction monitoring systems

These safeguards protect both the platform and its recipients.

Who Typically Searches for “Trolley Payout”?

Search intent behind this keyword commonly includes:

- Businesses evaluating payout providers

- Developers researching API documentation

- Recipients verifying incoming payments

- Compliance teams reviewing regulatory frameworks

Providing structured, neutral, and informative content aligns with Google’s Helpful Content standards and improves organic visibility.

Best Practices for Implementing a Payout Infrastructure

Before integrating a trolley payout system, businesses should evaluate:

- Geographic coverage

- Supported payout methods

- Compliance capabilities

- API flexibility

- Scalability limits

- Cost structure

- Reporting tools

Long-term scalability should be prioritized over short-term convenience.

Frequently Asked Questions

Is Trolley payout a consumer payment app?

No. It is typically used by businesses to send funds to recipients.

Does it support cross-border payments?

Yes, international disbursements are a core capability.

Can businesses automate payouts?

Yes, API-based automation supports recurring and bulk transfers.

Final Thoughts

A trolley payout infrastructure helps digital platforms manage global disbursements with compliance, automation, and scalability in mind.

As businesses grow internationally, payment workflows become more complex. Structured payout systems reduce operational friction while supporting regulatory alignment and security standards.