Trolley Payout: Scalable Global Disbursement Infrastructure for Modern Platforms

What Is Trolley Payout and Why It Matters

4

The term trolley payout refers to the global payment and compliance infrastructure provided by Trolley. The platform enables businesses to send mass payments to recipients across multiple countries while managing regulatory and tax documentation requirements.

As digital platforms scale, manual payout processes quickly become inefficient and risky. Automated disbursement systems help solve operational bottlenecks by centralizing payments, compliance checks, and reporting tools.

Core Components of a Trolley Payout System

A properly structured trolley payout workflow typically includes:

1. Recipient Onboarding

Recipients securely provide:

- Banking details

- Local currency preferences

- Required tax forms (e.g., W-8, W-9)

- Identity verification data

Automation reduces onboarding friction while maintaining regulatory standards.

2. Compliance Screening

Before funds are released, systems can run:

- Sanctions checks

- AML screening

- Fraud monitoring

- Identity validation

This step protects platforms from financial and reputational risks.

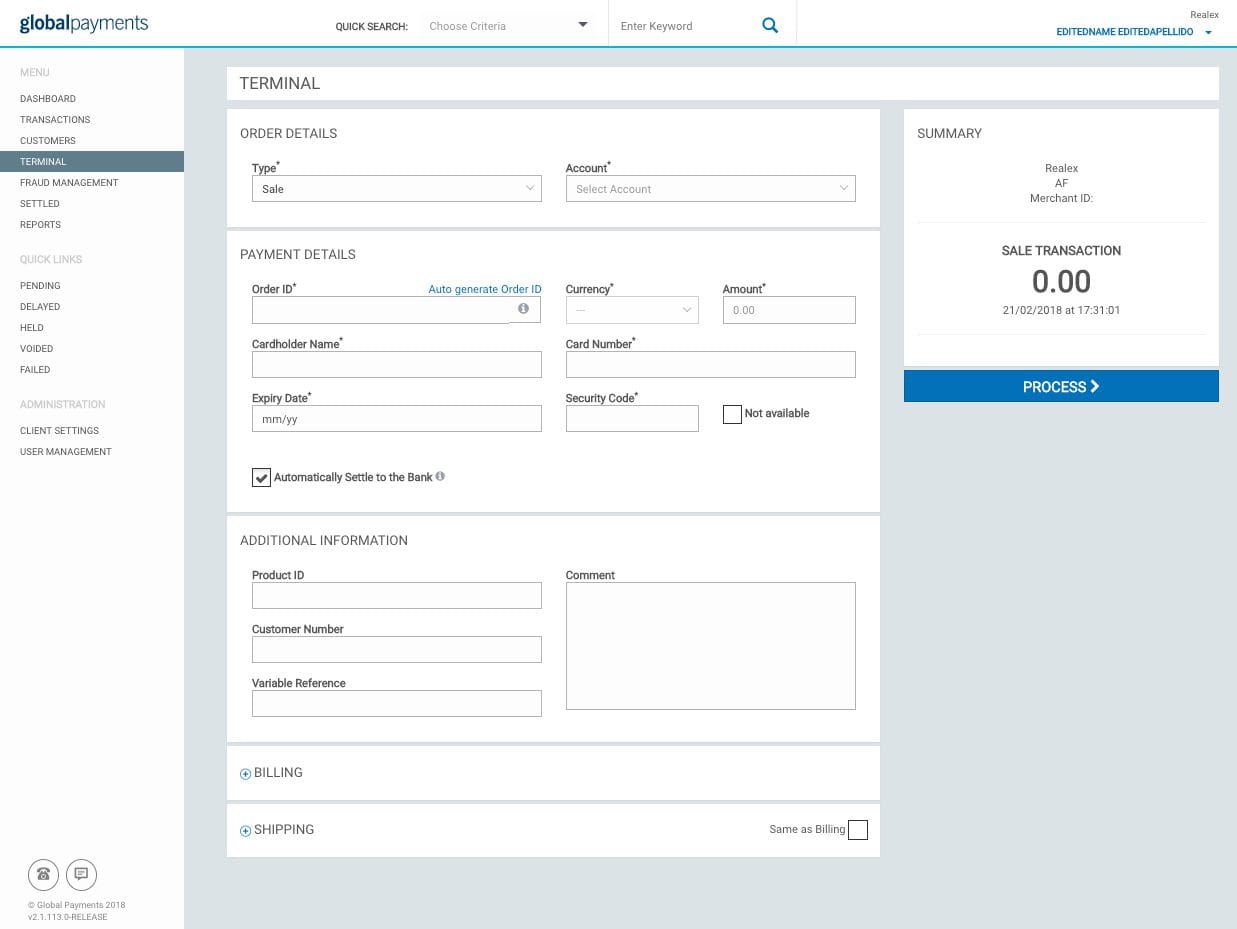

3. Global Payment Execution

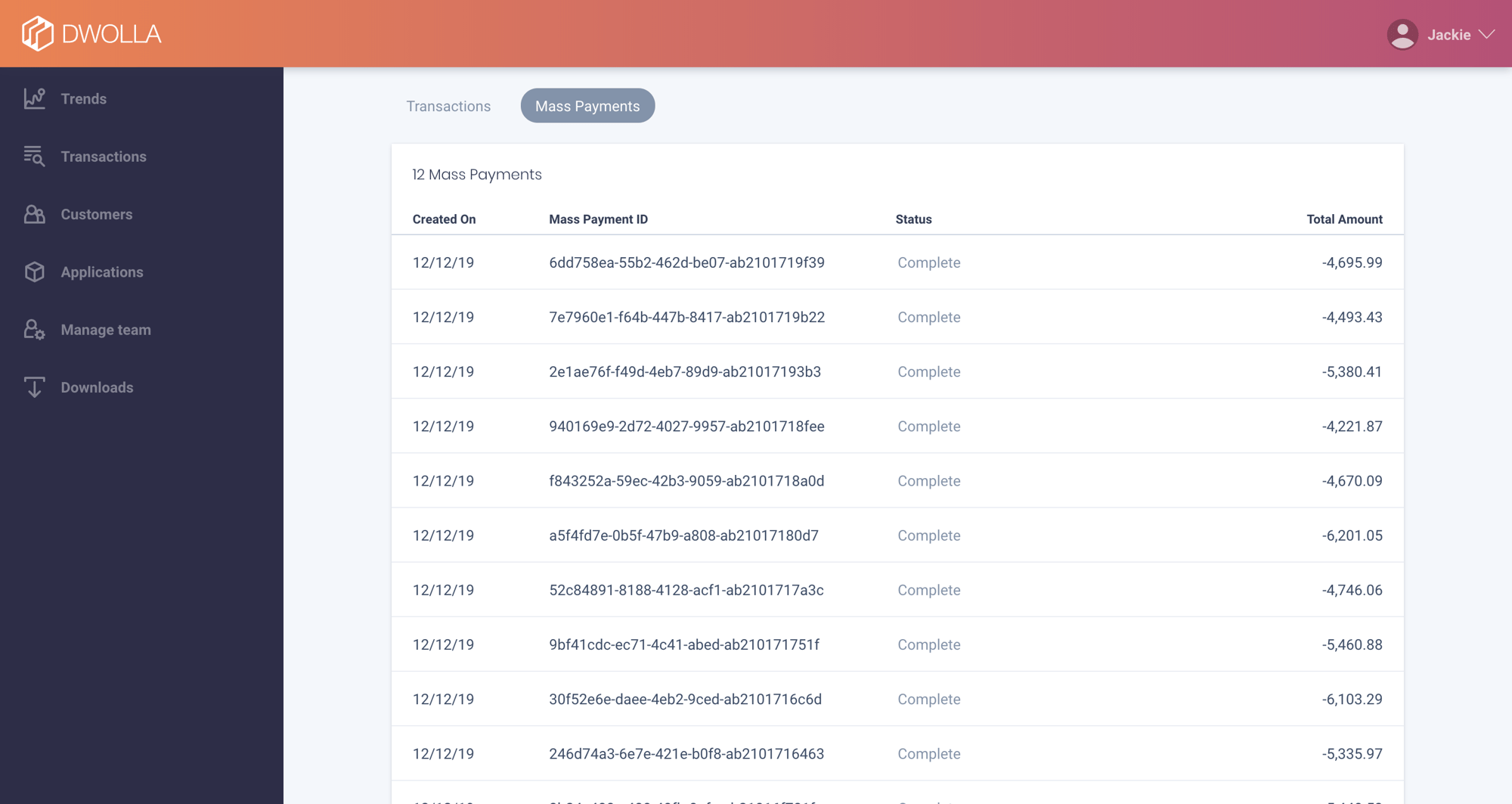

Businesses can initiate:

- Batch payouts

- Scheduled recurring disbursements

- API-triggered payments

Payments may be processed through ACH, SEPA, SWIFT, or local banking rails depending on geography.

4. Reporting and Tax Documentation

Built-in tools often support:

- Year-end reporting exports

- Automated tax form collection

- Centralized transaction logs

- Audit trails

Who Benefits From Trolley Payout Solutions?

4

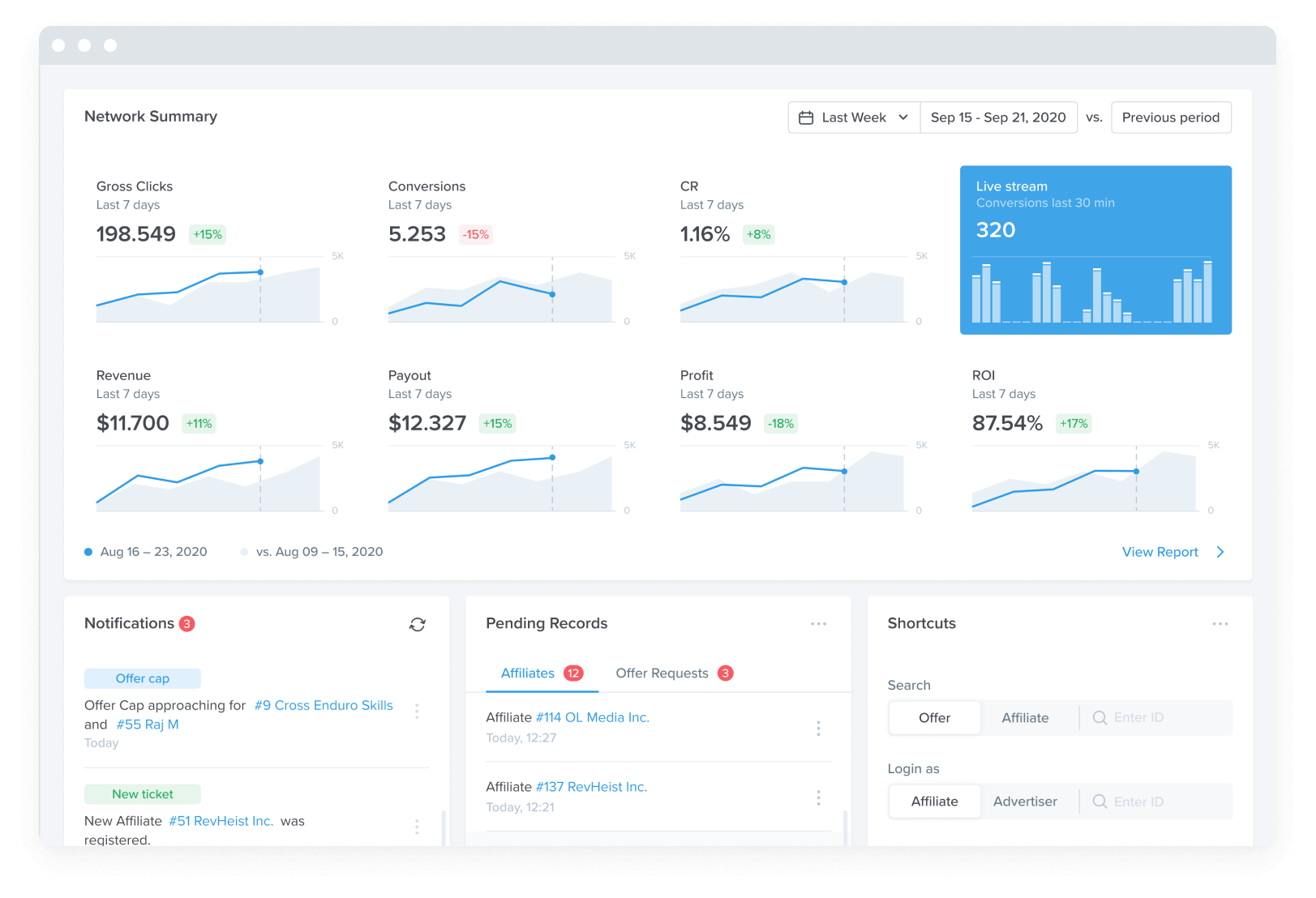

Trolley payout systems are frequently used by:

- Affiliate networks

- Creator platforms

- Online marketplaces

- SaaS ecosystems

- Ad-tech platforms

- Gig economy services

- Fintech applications

Any business that distributes funds to a large, geographically diverse audience may benefit from automated payout infrastructure.

Multi-Currency and Cross-Border Capabilities

Cross-border payments present challenges such as:

- Currency conversion complexity

- Banking delays

- Local regulatory requirements

- Higher transaction costs

A trolley payout framework typically allows businesses to:

- Send funds in local currencies

- Reduce foreign exchange friction

- Centralize cross-border operations

- Monitor payout status in real time

This scalability is especially important for digital-first companies expanding into new markets.

Security and Risk Controls

4

Security is a critical component of global payout systems.

Common protective measures include:

- Encrypted data transmission

- Role-based permissions

- Multi-layer compliance screening

- Real-time transaction monitoring

- Detailed audit logs

These controls help businesses maintain operational integrity and regulatory alignment.